The fact that you are reading this SAP FICO Tutorial drives me

to an assumption that you are familiar with the world of SAP and the

technological disruptions that have been rampant in it in the recent years.

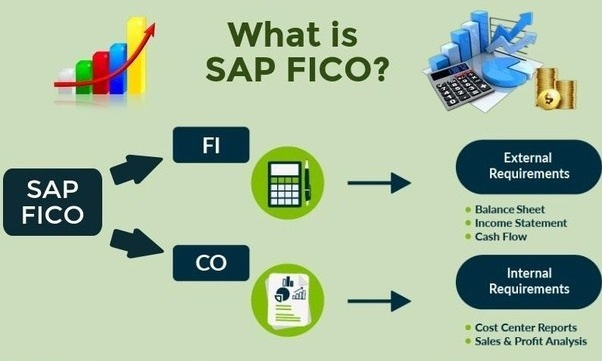

One such disruption is SAP FICO. An integration of SAP Finance Accounting

and SAP Controlling modules, SAP FICO often pops up in the mind of finance

specialists when they are supposed to operate around financial transaction

data. While SAP FI (Financial Accounting) records, collects, and

processes financial transactions in real-time for providing necessary inputs

for external reporting, SAP CO (Controlling) is leveraged for internal

reporting and improved decision making. The SAP FICO consultant job is a

symbolizes as one of the most lucrative career paths in the market today,

interested in learning SAP FICO? Click here to learn more in this SAP FICO Training!

Components of the Financial (FI)

Module

General Ledger Accounting

Accounts Payable

Accounts Receivable

Treasury

Asset Accounting

Consolidations

Organizational Units in FI

The Client

The client is the highest hierarchical level

in the SAP System. Specifications that you make or data that you enter at this

level are valid for all company codes and for all other organizational

structures. Each client is a self-contained unit with separate master records

and a complete set of tables.

The Company

A company is the smallest organizational unit for

which legal individual financial statements such as balance sheets and profit

and loss statements can be created according to the respective commercial

legislation. A company can include one or more company codes. The financial

statements of a company are also the basis of a consolidated financial

statement.

The Company Code

A company code is the smallest organizational

unit for which complete, independent accounting can be carried out. A legally

independent company is generally represented by one company code in the SAP

System. In accounting, you enter, save and process business transactions, and

manage accounts fundamentally at company code level. A further subdivision is

possible via internal organizational Units (Ex: Business Areas)

The Chart of Accounts

The chart of accounts is the second highest

hierarchical level in the SAP System. It is assigned to the company code. It is

a list of all natural accounts available to all company codes.

Terminology in FICO

Company Code

Smallest organizational unit of

external accounting for which a complete, self-contained set of accounts (COA)

can be created. Similar to what is now considered a legal entity.

Document

Representation of an accounting

document or entry in the SAP system

Chart of Accounts

A framework of GL accounts for the

recording of values to ensure an orderly rendering of accounting data. The

operational chart of accounts is used by financial accounting and cost

accounting. The items in a chart of accounts can be expense or revenue accounts

in FI and cost or revenue elements in cost accounting. Each company code is

assigned to a chart of accounts.

Profit Center

An organizational unit in

Accounting used for controlling purposes. Similar to what is now considered an

origin.

Cost Center

An organizational unit that

represents a defined location of cost incurrence. Similar to what is now

considered a department.

Customer Master

Customer data that includes

addresses, account balances, and credit limits that are maintained centrally to

prevent duplication.

Vendor Master

Vendor data that includes addresses,

payment details, and account balances of all vendors with which AOI conducts

business. Vendor master records are centrally maintained to prevent

duplication.

Posting Key

A two-digit numerical key that

determines the way line items are posted. This key determines several factors

including the account type, type of posting (debit or credit) and layout of

entry screens.

Account Group

Used to categorize accounts that have

similar master data requirements. It determines the required master data needed

for creating G/L accounts. It also determines the number range in which the

customer account should be placed, and whether that number is to be assigned by

the user or by the system.

Ledger

In G/L Accounting, you can use several

ledgers in parallel. This allows you to produce financial statements according

to different accounting principles, for example.

Fiscal Year Variant

A period as defined by the

financial calendar. The fiscal year variant contains the number of posting

periods in the fiscal year and the number of special periods. You can define a

maximum of 16 posting periods for each fiscal year in the Controlling component

(CO).

Posting Period

Variant

You can specify which company

codes are open for posting in a posting period variant. Posting period variants

are cross-company code and you have to assign them to your company codes. The

posting periods are then opened and closed simultaneously for all company codes

via the posting period variants.

Reconciliation

Account Summary account for sub

ledgers such as Accounts Receivable, Accounts Payable, and Asset Accounting. No

direct postings to reconciliation accounts are allowed.

Cost Element

A cost element classifies the

organization's valuated consumption of production factors within a controlling

area. A cost element corresponds to a cost-relevant item in the chart of

accounts.

Primary Cost

Element

A cost element whose costs originate

outside of CO and accrual costs that are used only for controlling purposes.

Open Item

Management

A stipulation that the items in an account must be

used to clear other line items in the same account. Items must balance out to

zero before they can be cleared. The account balance is therefore always equal

to the sum of the open items.

No comments:

Post a Comment